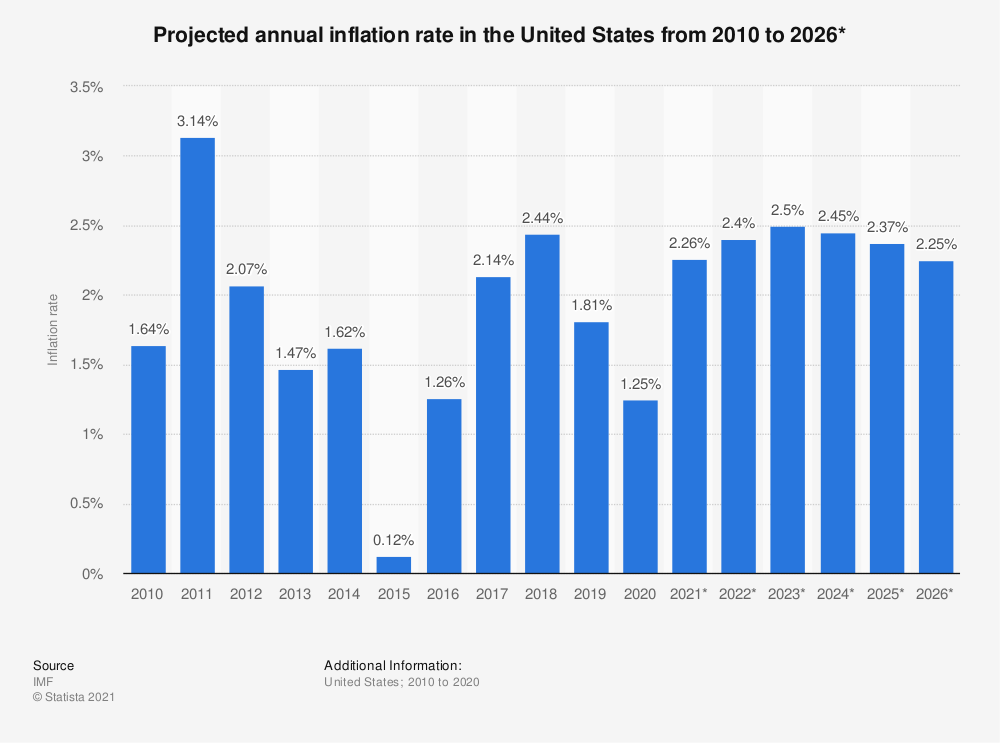

As more economic stimulus has been poured into the economy over the last year in an attempt to stave off the worst effects of the pandemic, an increasing number of economic professionals have warned against a coming spike in inflation.

While the United States historically has had a low overall rate of inflation compared to other countries, there are still some troubling signs for businesses to shield themselves against. Some inflation is inevitable as the country emerges from the pandemic simply as a normalization from the unusually low growth in 2020. Finding ways to creatively cope with a potential loss in the real value of company holdings is something every business should consider.

The period just before an expected rise in inflation can be one of the best to lock in rates on a loan – it’s a good way to get more value out of a potentially less valuable dollar down the road when the bills come due. That extra money can also be a big help for a business’s overall liquidity in a potentially difficult economic time. If you were already considering making large purchases, now may be the time to make those investments. Prices will likely continue to increase if supply continues to struggle to keep pace with the demand, and financing these purchases would become more expensive in terms of real value if the value of the dollar drops.

Along similar lines, it’s also a smart time to consider locking in terms for supplier contracts, which can end up saving a business a lot of money over the long-term. Fixed costs at a lower inflation rate over multiple quarters can add up to a big savings in real value.

Even given smart moves in advance, once a business is facing a high inflationary period, cutting costs is vital. Finding new ways to increase productivity with a potentially reduced staff is one option, as is finding efficiencies through technology that can automate processes that previously ate up a lot of man hours.

As businesses look to drive efficiencies, reviewing your internal processes can be a great place to start. Accounts receivable and payable reviews can identify gaps, which can lead to greater internal and vendor efficiencies.

This can be a tricky balancing act for any business. There are many stories of companies that take on extreme cost-cutting measures in times of crisis and wind up reducing the quality of their product and the reputation of their business in the process. That can spell long-term doom in a difficult marketplace.

And – if all of that simply isn’t sufficient to cope – it’s important to remember that while a price hike is never popular with consumers, a time of higher inflation can be one of the best times to raise prices. It takes a careful eye to judge just where and how much to push prices, but when rates are rising across the industry, there’s less risk of losing consumer demand. This is especially true of businesses in industries where prices have been increasing both this year and the past several years.

Staying transparent with customers throughout the process is key any time a business is thinking of raising prices, of course. Beyond consistency with market competitors, every step must be taken to avoid surprising customers.